Introduction

Education is one of the most important investments you can make in your future. But let’s face it—paying for college or university isn’t easy. With tuition fees, books, accommodation, and other costs adding up, many students and their families find themselves needing financial help. That’s where education loans come into play. These loans are designed to make higher education more accessible by covering the expenses that scholarships, grants, or savings can’t fully handle.

In this guide, we’ll take a closer look at the different types of education loans available. We’ll explain what they are, how they work, and which one might suit your needs best. Whether you’re a student looking to fund your studies, a parent trying to help your child, or someone planning to study abroad, this article will give you all the information you need to make a smart choice.

Understanding Education Loans

Before diving into the specifics, let’s start with the basics. What exactly are education loans? Simply put, these are loans that cover the costs of education. They can be used for tuition, books, housing, transportation, and even living expenses while you’re studying.

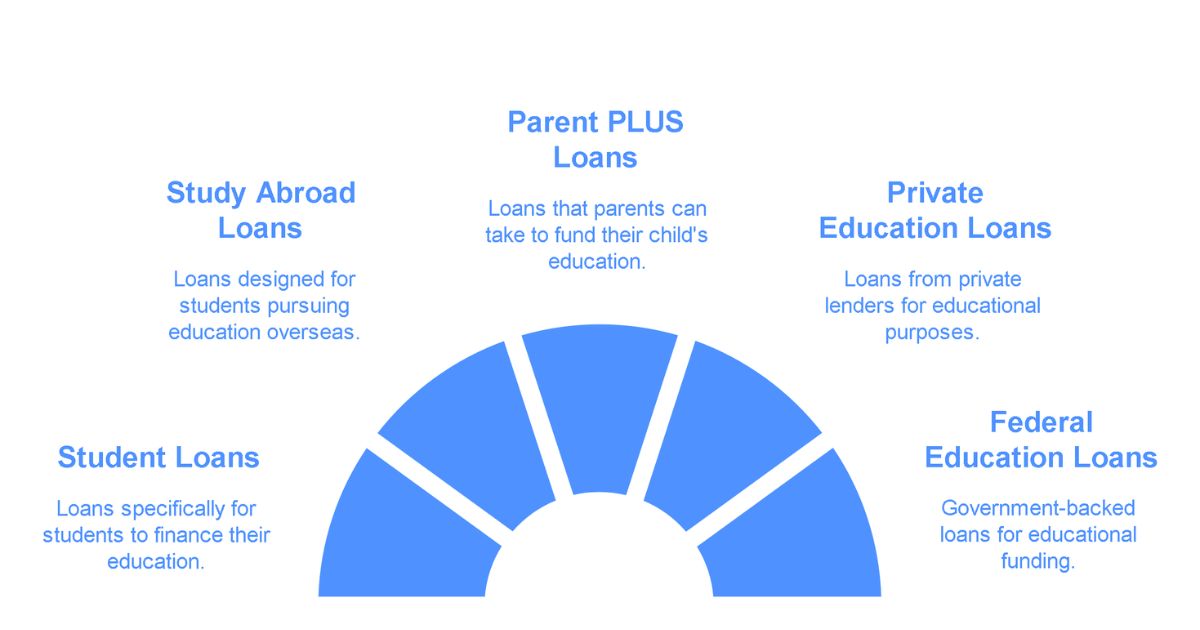

There are two main sources of education loans: government-backed loans and private loans. Government-backed loans, like federal education loans, usually come with lower interest rates and better repayment terms. Private loans, on the other hand, are offered by banks, credit unions, or online lenders. While they may offer larger loan amounts, they often have higher interest rates and stricter eligibility requirements.

The key features of education loans include:

- Eligibility: This could depend on factors like your income, credit score, or whether you have a co-signer.

- Interest Rates: Some loans have fixed rates, meaning the rate stays the same throughout the loan term. Others have variable rates, which can go up or down depending on market conditions.

- Repayment Terms: Some loans allow you to delay payments until after graduation, while others require you to start paying back right away.

Understanding these basics will help you navigate the different types of education loans we’ll discuss next.

Student Loans

Student loans are probably the most common type of education loan. These are specifically designed for students pursuing higher education, whether it’s a bachelor’s degree, master’s program, or even a vocational course.

One big advantage of student loans is that they’re often easier to get than other types of loans. Many programs don’t require a strong credit history because they’re aimed at young people who may not have had time to build one yet. Instead, eligibility is usually based on your enrollment in an accredited school and your financial need.

There are two main types of student loans: subsidized and unsubsidized. Subsidized loans are for students who demonstrate financial need. The government pays the interest on these loans while you’re in school. Unsubsidized loans, on the other hand, are available to all students, regardless of financial need. However, you’re responsible for paying the interest from day one.

While student loans can be a lifesaver, they do come with some downsides. For one, they add to your debt load, which can take years to pay off. Plus, if you don’t manage your payments carefully, you could end up damaging your credit score. Still, for many students, they’re the only way to afford a quality education.

Study Abroad Loans

If you’re planning to study in another country, you’ll need a loan that’s tailored to the unique challenges of international education. Study abroad loans are designed to cover not just tuition but also travel expenses, visa fees, and living costs in a foreign country.

One of the biggest hurdles with studying abroad is the cost of living in a different currency. To address this, many study abroad loans offer disbursals in foreign currencies, so you don’t have to worry about exchange rate fluctuations. Another feature of these loans is that they often require a co-signer, especially if you’re a student without a steady income or credit history. Some lenders may also ask for collateral, such as property or savings, to secure the loan.

The good news is that study abroad loans can open doors to world-class universities and global opportunities. On the flip side, they tend to have higher interest rates compared to domestic loans. This is partly because lenders see them as riskier due to currency changes and the uncertainty of employment after graduation.

If you’re considering a study abroad loan, it’s important to shop around and compare offers from different lenders. Look for ones that offer flexible repayment options and favorable terms.

Parent PLUS Loans

For parents who want to help their children pay for college, Parent PLUS loans are a popular option. These are federal loans available to parents of dependent undergraduate students.

To qualify for a Parent PLUS loan, you’ll need to pass a credit check. Unlike student loans, which don’t consider credit scores, Parent PLUS loans require borrowers to have a decent credit history. If your credit isn’t great, you might still be able to get the loan by bringing in a co-signer.

One of the standout features of Parent PLUS loans is the borrowing limit. You can borrow up to the total cost of attendance minus any other financial aid your child receives. This makes them a good option if federal student loans aren’t enough to cover all the expenses.

However, there are some drawbacks to keep in mind. For starters, the interest rates on Parent PLUS loans are higher than those on other federal loans. Additionally, the responsibility for repaying the loan falls entirely on the parent. This means you’ll need to make sure you can afford the monthly payments before taking out the loan.

Despite these challenges, many parents find Parent PLUS loans to be a valuable tool for supporting their child’s education.

Private Education Loans

When federal loans and scholarships aren’t enough, private education loans can fill the gap. These loans are offered by banks, credit unions, and online lenders, and they come with both advantages and disadvantages.

One of the biggest perks of private loans is flexibility. You can borrow larger amounts than what’s typically allowed with federal loans, and you don’t need to file a FAFSA (Free Application for Federal Student Aid) to qualify. However, eligibility depends heavily on your credit score and income. If you don’t meet the lender’s requirements, you’ll likely need a co-signer to secure the loan.

Interest rates on private loans can vary widely. Some lenders offer competitive rates, especially if you have excellent credit. But others charge much higher rates, which can add significantly to the overall cost of the loan. It’s also worth noting that private loans don’t come with the same protections as federal loans. For example, you won’t have access to income-driven repayment plans or loan forgiveness programs.

Because of these factors, private education loans should generally be considered only after exhausting all other options. But for some borrowers, they can provide the extra funding needed to complete their education.

Federal Education Loans

Federal education loans are backed by the U.S. Department of Education and are often the first choice for students seeking financial aid. There are several types of federal loans, each with its own set of rules and benefits.

The most common types include Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Subsidized loans are need-based, meaning the government covers the interest while you’re in school. Unsubsidized loans, on the other hand, are available to all students, but you’re responsible for paying the interest from the start.

One of the biggest advantages of federal loans is their low, fixed interest rates. These rates are set by the government and are typically much lower than what you’d find with private lenders. Federal loans also come with borrower-friendly repayment options, such as income-driven plans that adjust your monthly payment based on your earnings.

Another perk is the availability of loan forgiveness programs. For example, teachers and public service workers may qualify to have part of their debt forgiven after making consistent payments for a certain number of years.

The downside? Federal loans have strict borrowing limits, which may not be enough to cover all your educational expenses. In such cases, you might need to turn to private loans to bridge the gap.

Comparing the Different Types of Education Loans

With so many options available, it can be tough to decide which type of education loan is right for you. To make things clearer, let’s break it down in a simple comparison table:

So, which loan should you choose? It depends on your situation. If you’re a student with limited resources, federal loans are likely your best bet. If you’re heading overseas, a study abroad loan might be the way to go. And if you’ve maxed out federal aid, private loans could help you cover the rest.

Conclusion

Education loans can be a powerful tool for achieving your academic goals, but they’re not one-size-fits-all. By understanding the differences between student loans, study abroad loans, Parent PLUS loans, private education loans, and federal education loans, you can make a decision that works best for your unique circumstances.

Remember, taking out a loan is a serious commitment. Always read the fine print, compare offers, and think about how the loan will impact your finances in the long run. Education is an investment in yourself, and choosing the right loan can make all the difference in turning your dreams into reality.

Take the time to explore your options, and don’t hesitate to seek advice from financial experts or counselors if you’re unsure. Your future self will thank you for making a thoughtful, informed choice today.